New Info For Picking RSI Divergence Trading

Wiki Article

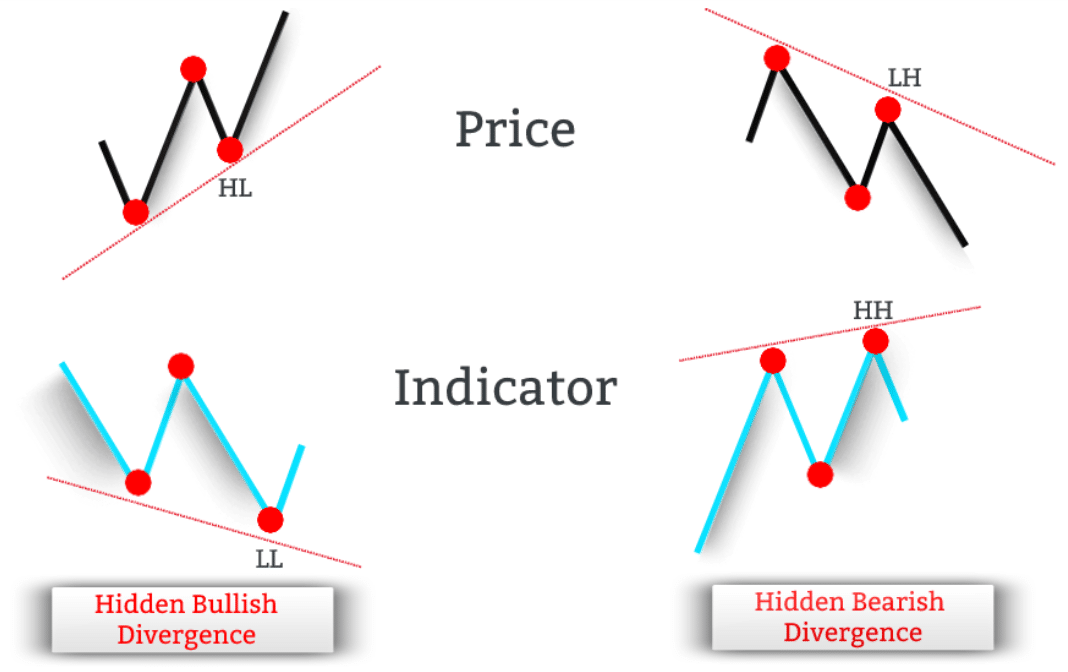

Let's begin by asking the obvious query and explore what is RSI Divergence is and what trading signals we can derive from it.|Okay, let's start by asking the obvious question. Let's look into what RSI Divergence means and what trading indicators it might offer.|Let's start with the most obvious question. We'll explore what RSI Divergence actually is and the trading information we can derive from it.|Let's begin by asking the most obvious question. Let's look at the meaning behind RSI Divergence really is and the trading signals we can take away from it.|Okay, let's get started with the obvious question. Now, let us look at the what RSI Divergence looks like and what information about trading can be learned from it.} When the price action and RSI indicators aren't in sync, a Divergence is evident in the chart. This means that in a Downtrend market Price will make a lower low, but the RSI indicator makes higher lows. In essence, a divergence occurs when the indicator does not coincide with price movements and when a situation like this arises, you should be aware of the market. Based on the chart, both bearish RSI divigence (bullish) and bearish RSI divigence (bearish) are apparent. However the price action has actually changed in the wake of both RSI Divergence signals. Let's discuss one last topic before move to the thrilling topic. View the best cryptocurrency trading bot for more info including crypto backtesting, automated crypto trading, RSI divergence cheat sheet, crypto trading backtester, trading with divergence, forex backtest software, best trading platform, forex backtesting software, RSI divergence cheat sheet, cryptocurrency trading and more.

How Can You Analyze The Divergence Of RSI?

We use RSI to determine trends that are reversing. This is why it is crucial to identify the most appropriate one.

How Do You Recognize Rsi Divergence In Forex Trading

Both Price Action indicator and RSI indicator have reached higher highs in the initial uptrend. This is a sign that the trend is strong. The trend is concluded with the price reaching higher levels, but the RSI indicator making lower highs. This means that something is to keep an eye on in this chart. Here we should be paying close attention to the markets as both the indicator's and price action are outof the sync. This indicates that there is an RSI divigence. In this instance, the RSI divergence is a sign of a bearish trend change. Check out the chart to see what occurred following the RSI Divergence. It is evident that the RSI divigence is extremely accurate in detecting trend reversals. However, the issue is: how do you actually detect the trend reversal, right? Let's examine four strategies for trade entry that can be combined with RSI Divergence to provide better entry signals. Have a look at the top forex trading for website recommendations including best crypto trading platform, online trading platform, backtesting platform, trading platform cryptocurrency, trading platform cryptocurrency, online trading platform, forex backtester, forex trading, divergence trading, automated trading platform and more.

Tip #1 – Combining RSI Divergence & Triangle Pattern

Triangle chart pattern is a pattern that can be utilized in two different ways. The first is the pattern known as the Ascending Triangle. It can be used as a reversal design during the downtrend. The other variation is the descending triangle pattern which is a reversal pattern in an uptrend market. Check out the descending triangular pattern as shown in the forex chart. The market was in an uptrend, and it eventually began to decrease. However, RSI also signals the divergence. These signals reveal the flaws in this uptrend. We now know that the current uptrend is losing momentum and as a result, the price ended up forming an descending triangle. This is also a confirmation of the reversal. It's now time to take the short-term trade. We followed the same breakout techniques as previously. Let's now get to the third technique for entry. This time, we'll combine trend structure with RSI diversgence. Let's look at how to trade RSI diversgence when the trend is shifting. See the top cryptocurrency trading bot for site tips including backtesting tool, crypto trading backtester, bot for crypto trading, forex backtester, position sizing calculator, automated trading platform, best crypto trading platform, automated cryptocurrency trading, trading platform crypto, best crypto trading platform and more.

Tip #2 – Combining RSI Diversity with Head &shoulders Pattern

RSI divergence is a technique forex traders employ to identify market reversals. It is possible to increase the probability of trading by using RSI diversification together with other factors that can cause reversals for example, the Head or Shoulders pattern. Now let's see how to timing our trades by combing RSI divergence with the head and shoulder pattern. Related - How to Trade Head and Shoulders Pattern in Forex - A Reversal Trading Method. It is important to make sure that the market is in a favorable state before we consider the entry of trades. A market that is trending is preferred as we are trying to identify an indicator of a trend reversal. See the chart below. Read the best automated trading for more tips including automated trading platform, software for automated trading, RSI divergence, crypto backtesting, forex backtesting software free, crypto trading backtesting, backtesting platform, backtester, automated trading, automated crypto trading and more.

Tip #3 – Combining RSI Divergence with the Trend Structure

Trends are our friends, isn't it! We must trade in the direction of trend as long as the market is trending. That's what experts tell us. This trend isn't going to last for long. It is bound to reverse at some time. Let's examine the structure of the trend and RSI divergence to determine how we can identify those changes early. We all know that the uptrend is making higher highs, while the downtrend is making lower lows. This chart illustrates this point. If you take a look to the left of this chart, you can observe that it's an downtrend that has a pattern of lower highs and lows. Then, look at the "Red Line" which shows the RSI divergence. Right? Price action creates lows, however the RSI creates lower lows. What does this tell us? Even though the market is creating low RSI does the opposite. This means that the downtrend that is currently in place is losing momentum. We should be ready for a potential reversal. Follow the top backtester for website advice including forex backtesting software free, automated trading bot, automated trading platform, forex backtester, backtesting, crypto trading, trading platform cryptocurrency, divergence trading forex, cryptocurrency trading, trading platform cryptocurrency and more.

Tip #4 – Combining Rsi Divergence With The Double Top And Double Bottom

Double top or double bottom is a reversal pattern that develops after an extended move or following a trend. Double tops form when the price reaches an unbreakable threshold. The price will begin to recover after reaching this level , but after that it will test the previous levels again. A DOUBLE TOP occurs when the price bounces off this level. Below is a double top. In the double top above, you will see that two tops formed after a strong move. It is evident that the second top was not able to surpass the one. This is a sure sign that a reversal is going to occur since it is signalling that the market that buyers are fighting to climb higher. The same set of principals applies to the double bottom, but oppositely. We employ the technique of entering trades using breakouts. In this instance we will sell the trade once the price is below the trigger line. The price surpassed our profit target within a matter of days. Quick Profit. Double bottoms are covered by the same strategies for trading. Below is a graph which will show you the best way to trade RSI diversgence with double top.

This isn't the ideal trading strategy. There is no one trading method that is ideal. Every strategy for trading has losses. This trading strategy earns us consistently, but we make use of strict risk management and a method to limit our losses swiftly. This will allow us to reduce drawdowns and opens the doors to huge upside possibilities.