Good Tips For Picking A Trade RSI Divergence

Wiki Article

Use Cleo.Finance To Trade Automatically RSI Divergence!

The term "divergence" refers to the direction in which the prices of an asset and of technical indicators change in opposing directions. Divergence between momentum indicators like the RSI or MACD is an effective tool to identify possible changes in the direction of an asset. It is an essential component of many trading strategies. We are pleased to reveal that you are now able to make use of divergence to design open and close conditions for your trading strategies using cleo.finance! Take a look at top backtesting for blog recommendations including backtester, software for automated trading, stop loss, trading platform crypto, trading platform crypto, trading platform crypto, automated trading, backtesting platform, best crypto trading platform, backtesting trading strategies and more.

There Are Four Major Types Of Divergences:

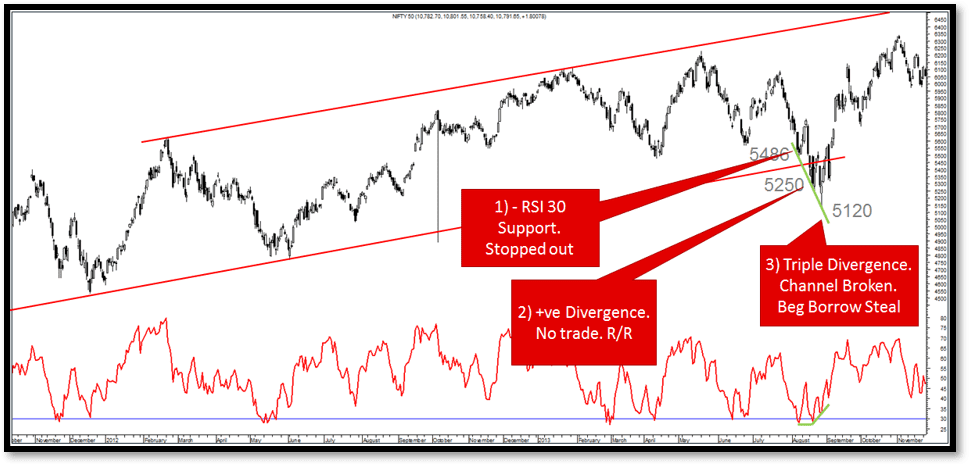

Bullish Divergence

The technical indicator has higher lows, and price has lower lows. This suggests a weakening of the momentum of the downtrend, and an eventual reversal to the upside.

Hidden Bullish Divergence

The oscillator is making lower lows while it has higher lows. A hidden bullish divergence could indicate that an uptrend is sustaining. This can be found in the top or tail of a price throwback which is also known as the retracement down.

Hidden Bullish Divergence Explanation

Quick Notes

Bearish Divergence

While price is creating higher highs and the indicators that show lower highs, it indicates that the price is making more highs. This indicates that momentum towards the upside is decreasing and a reverse to the downside may be expected.

Bearish Divergence Explanation

Quick Notes

Hidden Bearish Divergence

The oscillator is making higher highs as the price makes lower highs. An unnoticed bearish divergence could suggest that the trend downwards is continuing. It is usually found at a tail end to the price pullback or a retracement.

Hidden Bearish Divergence Explanation

Quick Notes: if you are watching price peaks during a drawback in a downtrend and price falls first.

Regular divergences provide a reversal signal

A trend reversal is identified by the frequent divergences. These signs indicate that the trend is still strong but its momentum has dropped. This can be a warning signal of possible changes in direction. Divergences can be powerful triggers for entry. Take a look at recommended backtesting platform for site info including backtesting platform, backtesting strategies, trading platform, forex backtesting software, stop loss, automated trading software, bot for crypto trading, stop loss, forex backtesting software, crypto trading and more.

Hidden Divergences Signal Trend Continuation

Hidden divergences, however, are signals of continuation that typically are seen in the middle of a current trend. They signify that the current trend will continue following a pullback and can be powerful entry triggers when confluence evident. Hidden divergences are typically utilized by traders to connect the current trend following a pullback.

Validity Of The Divergence

A momentum indicator like RSI and Awesome oscillator is the best way to measure the divergence. These indicators do not focus on past momentum. Thus the ability to predict divergence greater than 100 candle distance from now is not possible. The indicator's look-back period can be changed to determine if there is a valid divergence. Be cautious when deciding if a divergence is valid. Divergences may not be valid.

Available Divergences in cleo.finance:

Bullish Divergence

Bearish Divergence

Hidden Bullish Divergence:- Follow the most popular backtester for more recommendations including automated trading software, forex tester, RSI divergence, cryptocurrency trading bot, bot for crypto trading, backtesting platform, best crypto trading platform, divergence trading, automated cryptocurrency trading, position sizing calculatorand you can compare those divergences between two points:

Price With An Oscillator Indicator

An oscillator indicator with another indicator. Price of any asset along with any other asset.

A guide on how to make use of divergences using cleo.finance builder

Hidden Bullish Divergence cleo.finance - Construction open conditions

Customizable Parameters

There are four options which can be modified to tailor divergences.

Lookback Range (Period)

This parameter specifies the distance back to which the strategy be looking for the divergence. The default value is 60. This signifies "Look for the divergence anyplace within the last 60 bars."

Min. Distance Between Peaks/Troughs (Pivot Lookback Left)

This parameter defines how many candles on the left side are required to verify that the pivot point is found

Confirmation bars (Pivot Lookback Right)

This parameter specifies the number of bars must be placed to confirm the pivot point is found. View the recommended position sizing calculator for site examples including trading platform, automated trading, cryptocurrency trading bot, crypto backtesting, trading platform cryptocurrency, automated trading bot, trading platform cryptocurrency, forex tester, crypto trading backtester, crypto trading backtesting and more.

Timeframe

It is possible to define the period of time during which the divergence should be observed. This timeframe can be different from the execution timeframe of the strategy.Customizable parameter settings of divergences on cleo.finance

Parameters for Divergences settings on cleo.finance

The peak and the trough are determined by the settings for pivot points. The default settings for a bullish diveRSIfication should be kept.

Lookback Range (bars) 60, 60

Min. Distance between troughs is (left) = 1.

Confirmation bars, right = 3

That means both the troughs of the divergence should be found within the next 5 bars (lower then 1 bar either side, or 3 bars to one side). This applies to both troughs that are within the last 60 candles (lookback range). Three bars after the closest pivot point is found, the divergence will be confirmed.

Available Divergencies In Cleo.Finance

The most popular uses of RSI divergence are MACD diversgence. However, rest assured that any other oscillator is also able to be tested and traded live using the platform for trading automation cleo.finance. Take a look at best best forex trading platform for blog recommendations including forex trading, crypto trading backtester, bot for crypto trading, stop loss, trading platform, position sizing calculator, forex backtest software, online trading platform, best forex trading platform, forex backtesting and more.

In Summary

Divergences can help traders add an important tool in their arsenal. However , they shouldn't be utilized without careful plan. This will help traders make more informed trading decisions using divergences. It is crucial to approach the concept of divergences with a clear head. When you combine them with other fundamental and technical analysis, like Fib Retracements or Support and Resistance lines, only boosts the credibility of the divergence's validity. The Risk Management guides provide information regarding stop loss positioning and size of the position. Start designing your ideal trading strategies for divergence right now with more than 55 indicators for technical analysis, price action, and candlesticks data points! We're constantly improving our cleo.finance portal. Let us know if you have any questions or suggestions for data points.